The Main Principles Of Ach Processing

Table of ContentsNot known Facts About Ach ProcessingAn Unbiased View of Ach ProcessingWhat Does Ach Processing Do?The Only Guide for Ach Processing

A lot more lately nonetheless, banks have concerned enable same day ACH payments or next-day ACH transfers that take just one to two company days. As long as the digital repayments demand is sent prior to the cutoff for the day, it's possible for the cash to be gotten within 24 hours.Whatever sort of ACH settlements are entailed, a transfer is a procedure of 7 actions, which begins with the cash in one account and also ends with the money getting here in an additional account. ACH repayments start when the begetter (payer)begins the procedure by asking for the deal. The pioneer can be a consumer, business, or a federal government firm.

Once a transaction is launched, an entry is sent by the financial institution or payment processor taking care of the initial phase of the ACH payments process. The financial institution or settlement cpu is understood as the Originating Depository Financial Organization (ODFI). Economic establishments usually send out ACH entrances in batches, normally 3 times a day during regular company hours.

Federal Reserve banks as well as the EPN are nationwide ACH drivers. As soon as obtained, an ACH driver types the batch of entries into down payments and also settlements, as well as repayments are after that arranged right into ACH credit report as well as debit settlements.

What Does Ach Processing Do?

When getting ACH payments, the getting monetary establishment either credits or debits the getting bank account, depending on the nature of the transaction. While the overall price connected with accepting ACH settlements varies, ACH fees are often more affordable than the costs related to accepting card settlements. Among the biggest cost-influencers of accepting ACH settlements is the quantity of purchases your company means to procedure.

Whether you're an acquirer, settlements cpu or merchant, it's vital to be able to gain total real-time visibility right into your payments environment. Badly doing systems increase frustration throughout the entire repayments chain. It can result in lengthy queues, the likelihood of customers deserting purchases, and also dissatisfaction from consumers badly influencing income.

IR Transact simplifies the complexity of handling contemporary settlements communities, including ACH payments. Bringing real-time presence and repayment monitoring to your entire atmosphere, Negotiate uncovers unparalleled insights into ACH purchases as well as payments fads to assist you simplify the settlements experience, turn data into intelligence, as well as guarantee the settlements that maintain you in service.

/ach-vs-wire-transfer-3886077-v3-5bc4cc6d4cedfd0051485d64.png)

10 Easy Facts About Ach Processing Explained

Possibilities are you have actually already utilized ACH settlements, yet are not acquainted with the jargon. ach processing. Some of the examples of ACH deals include: Online bill payments through your bank account, Transferring money from one bank account to another, Paying suppliers or getting cash from consumers by means of straight deposit, Straight down payment pay-roll to a worker's monitoring account used by business, Let's check out ACH payment refining much more in information.

The ACH network of monetary establishments (banks as well as lending institution) promotes purchases in the USA and also is handled by National Automated Cleaning Residence Organization (NACHA). According to NACHA, ACH settlements per day surpassed 100 million in February 2019. The most recent Bonuses numbers from NACHA exposed a 7. 1% boost in ACH transaction volume for the very first quarter of 2020, with B2B settlements uploading an 11.

You transfer cash to a Silicon Valley Financial institution account from your Financial institution of America account. Both the financial institutions have to credit history as well as debit each other's accounts.

ACH is one such central cleaning system for banks in the United States. ach processing. Wire transfers are interbank digital payments. While cord transfers seem to be similar to ACH transfers, below are some crucial distinctions between them: Can take a couple of organization days, Instant, Free for a receiver, nominal charges ($1) for a sender, Both the sender and receiver are charged charges.

More About Ach Processing

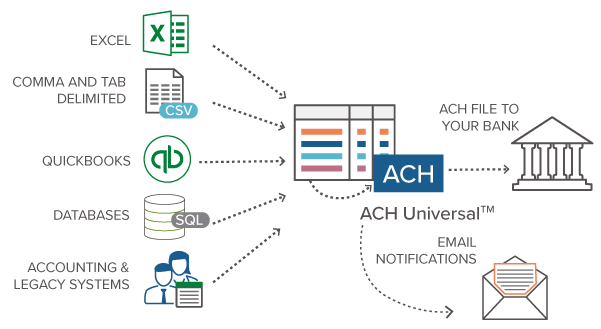

Can be challenged if problems are met, When launched, can not be canceled/disputed, No human intervention, Normally entails bank employees, Both send and ask for repayments. For settlement requests, you need to upload the ACH file to your financial institution. Just send out settlements, Refined in batches, Processed real-time, A cable transfer is suitable for you when time is essential, while ACH handling is a much better choice for non-mission-critical and also persisting payments. Now in any transfer, 2 individuals are entailed.

Your consumer accredits you to debit their bank account on his part for recurring deals. Allow's state Jekyll you can try here has to pay an amount of $100 to Hyde (assume they're 2 various people) as well as determines to make a digital transfer. Right here is an action by step break down of how a bank transfer using ACH jobs.

Comments on “Little Known Questions About Ach Processing.”